Latest In 2025, Monster Hunter Fell Prey To Profit 2026

There's no predator more vicious than infinite growth.

Capcom couldn't have hoped for a better environment to release Monster Hunter Wilds into. Monster Hunter was already ascendant: World was a breakout success that thrust the series into global awareness, and after glutting itself on Elden Ring the gaming public had a mainstream interest in precise, demanding third person combat and systems-heavy buildcraft. At launch, that math held true. In three days, Monster Hunter Wilds had sold a triumphant 8 million copies—the fastest-selling launch in Capcom's history.

10 months later, the story of Monster Hunter Wilds has a very different tone. On Steam, its review rating hangs at a middling Mixed, having intermittently plunged to Mostly Negative when updates either neglect or worsen the game's profound performance issues. By July, its sales had collapsed—and after news broke that it had gone from 10 million launch sales to less than 500,000 in a quarter, Capcom's stock price plummeted alongside.

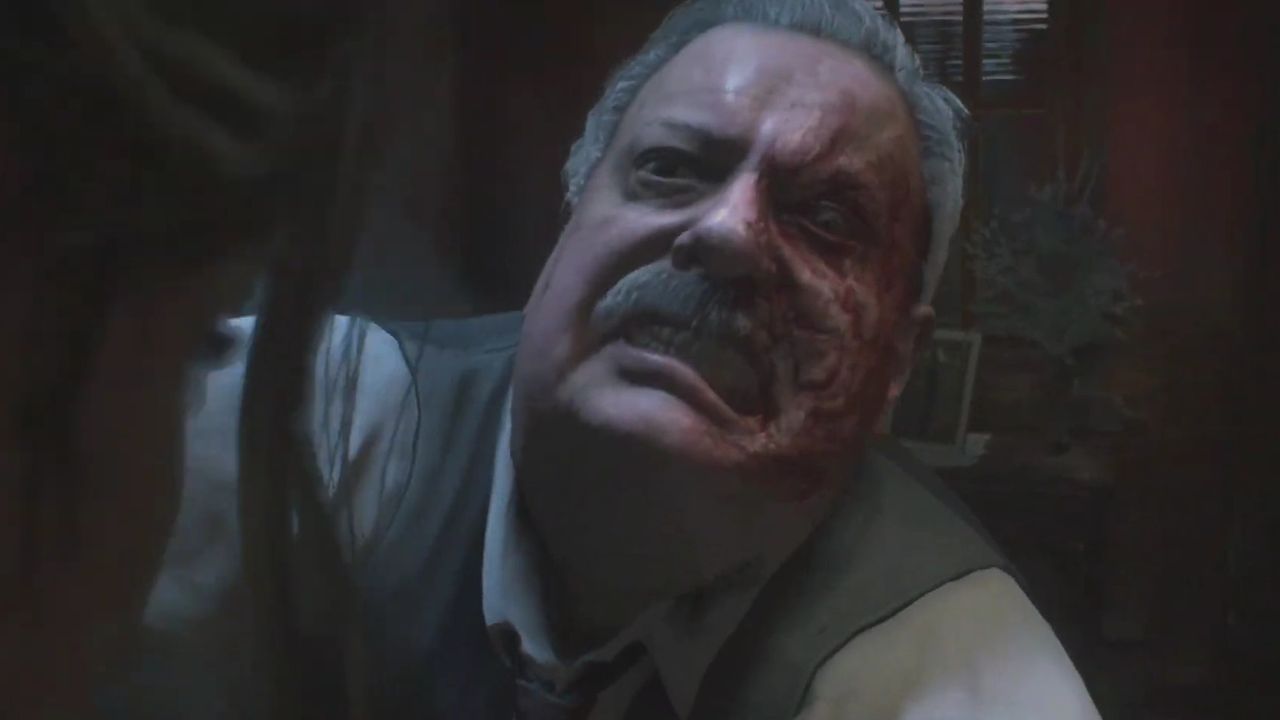

When I spoke to Wilds art director and executive director Kaname Fujioka in December 2024, he said Wilds was an attempt to ensure that the world can "truly become fans of the franchise." It was aimed at securing Monster Hunter's place as a premier, mainstream series that can stand shoulder to shoulder with Street Fighter and Resident Evil in Capcom's catalogue. Why instead has it been marred by technical faults, microtransaction cruft, and a faltering sense of series identity?

It's because, in 2025, Monster Hunter was Capcom's best choice to sate its hunger for infinite growth.

In its quarterly earnings calls and integrated yearly reports, Capcom regularly cites an ambitious goal: The publisher will—must—increase its operating profits by at least 10% each year and every year. Since 2015, Capcom has maintained that streak, and in its corporate messaging, it's presented as a self-evident truth. Fish will swim. Birds will fly. Capcom's operating profits will have grown by at least 10% by the end of the financial year.

It's what Capcom investors expect and what Capcom management delivers. And as the 2024 financial year progressed, it's a mark that Capcom was failing to meet.

2023 had been a good year for Capcom: More than continuing its years of consecutive profit growth, the celebrated launch of Street Fighter 6 helped the company break its record for game copies sold in a single year by a healthy margin. But as Capcom progressed into FY2024, that sales momentum fal

Source: PC Gamer